Welcome to Omaha, Nebraska! Two of my sons and I are among the 40,000+ people attending the Berkshire Hathaway (BRK) 2016 Annual Shareholders’ Meeting.

The actual meeting was from 9:30 AM to 4:00 PM yesterday (Saturday 4/30) but the whole weekend is filled with various activities including shopping at BRK businesses where shareholders get substantial discounts, running in the “Invest in Yourself 5K,” receptions, cookouts, ping pong contests, newspaper throwing contests, and exploring the exhibit floor of BRK firm displays. Some of the firms are wholly-owned by BRK (such as See’s Candies and Dairy Queen); others are partially-owned (such as Coca Cola, 10% BRK). It was interesting to see all the businesses that I didn’t know BRK owns…RV’s, pontoon boats, pre-fabricated housing, Brooks running shoes, Borsheims jewelry, Furniture Mart, Fruit of the Loom, Kraft Heinz, NetJet, and more. Of course, insurance, banking, and railroads are still a big part of BRK holdings.

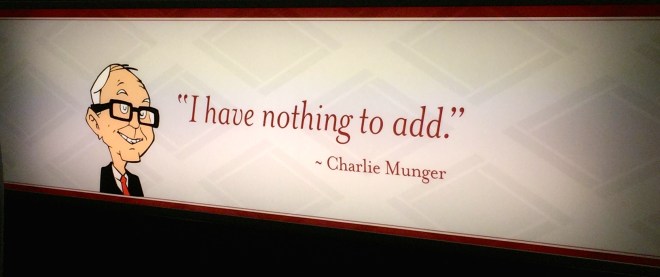

We arrived early to get a seat inside the auditorium that holds 18,000. It was filled up by about 7:30 AM. The movie at 8:30 featured SNL actors and other famous people, all of whom donated their time and talents. At 9:30 promptly, Warren Buffet, CEO and Chairman, and Charlie Munger, Vice-Chairman, took their seats on the stage. For the next 5 1/2 hours they answered questions from shareholders and industry analysts both in the auditorium and around the world. The meeting aired worldwide for the first time and included a translated version in China. Questions were not screened so there were no prepared answers. Warren did most of the talking but Charlie chimed in whenever appropriate. Mostly, Warren offered Charlie a chance to talk but his standard response was: It was very impressive how Warren (85) and Charlie (92) have such a command of the BRK holdings, performance, industry trends and general business acumen.

It was very impressive how Warren (85) and Charlie (92) have such a command of the BRK holdings, performance, industry trends and general business acumen.

A question about health concerns of sugar consumption and drinking Coke didn’t keep either of them from drinking Coke and eating See’s peanut brittle throughout the meeting. And a question about lack of diversity on the board didn’t phase them either. The answer was simple–we look for the best board members we can find in terms of intelligence, experience and passion about BRK, regardless of ethnicity. I didn’t recognize most of the board members but Bill Gates was there sitting on the front row in his blue sweater. The combined wealth of just Bill and Warren is well over 100 billion dollars. I can’t even imagine that much wealth.

A resolution brought by Nebraskans Peace Foundation which owns one share of BRK Class A would require BRK to evaluate global warming and address it as a danger to the insurance holdings was voted on and turned down. Warren opposed the resolution and politely explained that insurance policies are priced and offered year-by-year, therefore, companies could raise prices or assume less risk if climate change warrants it. Regardless, speakers were allowed to share their concerns. This seemed to be just an opportunity for the environmentalists to be heard and not a legitimate business concern.

In spite of the fact that a large percentage of the audience works in the financial sector, Buffett clearly holds financial advisors and fund managers in fairly low esteem. He implied that the huge fees the fund managers earn is to blame. His bet that the S&P would out-perform any 5 hedge funds over a 10-year period will end soon and it seems he’ll win by large margin (65.7% v. 21.9% so far). http://longbets.org/362/

BRK consistently out-performs the S&P. $1,000 invested in the S&P 500 51 years ago when Buffett bought majority interest of BRK (1965) would be worth $112,341 today. The same $1,000 invested in BRK would be worth $15.3 million today.

Buffett light-heartedly said if you hear a baby crying it could be his newest great-grandchild (7 months old) just learning about his philosophy on inherited wealth. When asked about conflicts of interest in personal holdings, he said 99% of his wealth is in BRK and any outside holdings are carefully scrutinized not to be a conflict. Further, he said that he has more money than he’ll ever spend and 99% of it will go to charity so he has no need to accumulate more wealth. He said he derives more pleasure in seeing BRK become richer than increasing his personal wealth. And, he hopes that BRK will go on profitably long after him.

When asked about his advice for success, Warren gave a similar answer to a question about a succession plan, noting that this subject comes up at every meeting. He has no desire to retire. He’s doing what he loves, with people he loves adding that the board and policies will keep BRK strong, long after he and Charlie are no longer there. The managers of the various sectors were praised, especially the insurance czar.

We spent the afternoon, along with Bill Gates and 40,000 others in attendance, listening to Warren Buffett and Charlie Munger discuss financial statements, business valuations, their search for well-managed, profitable businesses to acquire, and related topics. Time well spent. Plus, I got to see a bit of Omaha and enjoy the excellent company of Patrick & Daniel who flew in from Los Angeles.

(picture of Chihuly sculpture at the Joslyn Art Museum)

All in all, I’ll come back to Annual Shareholders’ Meeting any year I get the chance. Don’t suppose there’s anything we can do to change the cold, rainy weather.